Through three quarters of 2019, South Coast sales continue to reflect a more selective posture from investors, while owner-users have assumed a prominent role, enabled by favorable financing. Dollar volume for sales of office property has been unprecedented, while retail and industrial property have generated below-average activity.

Through three quarters of 2019, South Coast sales continue to reflect a more selective posture from investors, while owner-users have assumed a prominent role, enabled by favorable financing. Dollar volume for sales of office property has been unprecedented, while retail and industrial property have generated below-average activity.

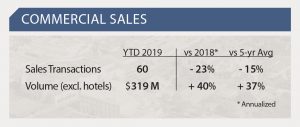

With 60 sales to date on the South Coast, transaction volume is trending about 15% below the prior 5-year average. However, transaction momentum stepped up in Q3 to produce a robust 25 sales. Thanks to the boom in office sales, dollar volume for all property types combined is 24% above the prior 5-year average.

Office volume to date has already reached $245 million, which is $100 million beyond the previous high for a full year. The historic dollar volume stems from a handful of high-value sales, including 6300 Hollister Ave in Goleta, 4050 Calle Real in Santa Barbara, and 6410 Via Real in Carpinteria, all three of which traded above $30 million. The motivations leading the owners of high-value properties to sell in 2019 appear to be varied, meaning the current spike in volume is largely a coincidental aligning of the stars, rather than indicative of a new trend. However, it’s safe to say that market timing—10 years into the current economic expansion—was always a factor under consideration.

In contrast to the rally in the office sector, retail and industrial sales as of Q3 were down 45% and 10%, respectively, compared to prior 5-year averages. Lagging industrial sales can be attributed to lack of supply, given that the number of industrial properties for sale has been in the single-digits throughout 2019. The most notable industrial sale to date was 6155 Carpinteria Ave in Carpinteria, purchased by an owner-user for $8 million. Meanwhile, retail property is in record supply, with 22 properties on the market. The dip in retail sales appears to correlate with pervasive concern over trends in brick-and-mortar retail. (Though in truth, aside from State Street in downtown Santa Barbara, retail vacancy on the South Coast has remained very stable and would be envied in most markets.) There also seems to be a gap in price expectations between retail owners and potential buyers. Nevertheless, two properties on State Street’s downtown retail corridor sold in Q3, including the 58,762 sf multi-tenant retail and office building at 827-831 State St, purchased by an investor for $23.5 million. There are still 10 properties for sale downtown on State Street.

Owner-users have represented 53% of buyers and the same percentage of dollar volume. Two of the $30-plus million sales mentioned above—4050 Calle Real in Santa Barbara, and 6410 Via Real in Carpinteria—were purchased by owner-users. The latter was a Q3 sale in which LinkedIn acquired the 87,000 sf office park that it has leased for many years. In Goleta, 420 S Fairview Ave ($22.8 million) and 454 S Patterson Ave ($14.8 million) were both off-market purchases by owner-users. Clearly, it’s not just small mom-and-pop businesses that are deciding to buy real estate for their own use.

Looking ahead, the Fed has cut interest rates for a third time this year, which should help stoke demand and encourage more buyers to enter the market. On paper, with 69 properties for sale on the South Coast there is ample inventory to sustain strong sales activity. However, investors have become more choosey since the beginning of 2018. Investor demand is strong for high-quality property in good locations. Premium assets routinely receive off-market inquiries from interested buyers and are generating multiple offers when brought to market, provided the price meets market expectation. Fortunately, the remarkable rise in owner-user demand and sales activity has served to fill some of the void left by investors. Provided the deceleration in the broader economy continues to be gradual, market conditions—and strong sales velocity—are likely to continue into early 2020.

Q3 Sales of note:

- 6300 Hollister Ave, Goleta. $33.1 million 106,309 sf office/R&D facility on 6.9 acres purchased by an investor

- 6410-6460 Via Real, Carpinteria. Off-market $30.4 million 87,138 sf 6-building office park on 9.1 acres purchased by an owner-user

- 827-831 State St, Santa Barbara. $23.5 million 58,762 sf retail/office building purchased by an investor

- 1486 East Valley Rd, Montecito. $13 million 6,357 sf office/retail building purchased by an investor

- 2323 Oak Park Ln, Santa Barbara $6.2 million 7,625 sf medical office building purchased by an investor

- 3793 State St, Santa Barbara. $4.2 million 4,477 sf office/retail building leased to Fidelity Investments purchased by an investor