InTouch Health signed leases in Q3 totaling 74,500 SF at Hollister Business Park in Goleta

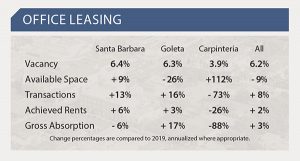

South Coast office leasing has been robust in 2019, especially in Goleta where momentum from record volume in 2018 has carried forward to the present. Achieved rents have also ascended to new heights. The remarkable inversion of vacancy curves still shows Goleta with a lower rate than Santa Barbara—a reversal that would have seemed impossible a few years ago—and the gap is likely to widen.

South Coast office leasing has been robust in 2019, especially in Goleta where momentum from record volume in 2018 has carried forward to the present. Achieved rents have also ascended to new heights. The remarkable inversion of vacancy curves still shows Goleta with a lower rate than Santa Barbara—a reversal that would have seemed impossible a few years ago—and the gap is likely to widen.

Santa Barbara

- Transaction volume and gross absorption are on par with the prior 5-year averages. The vacancy rate contracted slightly in Q3 but at 6.4% is still very high by historical standards.

- Only two leases larger than 10,000 sf have been signed to date, both by tech firms: Sonos renewed 27,217 sf at 614 Chapala St, and Honey Science subleased 18,792 sf at 530 Chapala St.

- There are 51 properties for lease downtown—the largest inventory on record—totaling more than 220,000 sf and including five spaces larger than 10,000 sf.

- 20% of current inventory came to the market in Q3, including 4,298 sf of warehouse space at 727 Bond Ave and 1,204 sf of light industrial at 12 Ashley Ave.

- There has been a surprising lack of medical leasing. Other than a 1,000 sf renewal at 215 Nogales Ave by Montecito Geriatric Medical Group, there have been no leases of traditional medical space to date. The subdued level of activity is not for a lack of supply: 14 properties are for lease totaling 44,000 sf of medical space.

- Achieved rental rates have continued to rise in 2019—increasing 5% compared to 2018 and 13% compared to 2017. The average rate for leases to date is $3.00 gross per square foot, a new high mark.

Goleta

- As in Santa Barbara, achieved rental rates in Goleta are breaching a new threshold: the average rate for leases to date is $2.00 gross per square foot. This reflects both healthy demand by tenants as well as increased landlord investment in improvements during the current economic cycle.

- The largest available space is the 82,132 sf building at 125 Cremona Dr, which is being vacated by Medtronic.

Leasing activity coasted in Q3, compared to heavy volume in the first half of the year. Gross absorption and transactions to date are still in step with the record levels posted in 2018. - Demand continues to be very strong, and activity is expected to rebound significantly in Q4. In fact, early Q4 leases and deals in negotiation could bring the vacancy rate to 5% or even lower by year end.

Carpinteria

- The office market in Carpinteria and Summerland has been quiet, with just two transactions to date and no known tenants actively looking in the area.

- The first half of the year saw record-low vacancy around 1.5%. However, three spaces became available in Q3 in Carpinteria and one more in Summerland, which notched the vacancy rate up to 3.9%.

Q3 Office Leases of note:

- 57,385 sf renewed at 7402 & 7406 Hollister Ave in Goleta by InTouch Health

- 17,177 sf leased at 7410 Hollister Ave in Goleta by InTouch Health

- 6,147 sf leased at 111 W Micheltorena St in Santa Barbara by Bragg Live Foods